Watch my sine die interview with TVW’s The Impact

Dear Friends and Neighbors,

The regular 2025 legislative session wrapped up yesterday, on schedule – although a “special” session can’t be ruled out if the governor takes issue with the new budget.

At times, this session felt even longer than 105 days, especially when fighting against the majority’s determination to approve bad policies that will negatively affect people across the state.

Being in the minority, it’s easy to get frustrated by the limits on our ability to advance bills that are important to our constituents. Sometimes, our successes have to come in the form of stopping bad legislation.

This year, we saw the majority attempt to increase taxes by $21 billion and, despite a with a multibillion-dollar budget shortfall, increase spending in an unsustainable way. That same uncontrolled spending is what created the shortfall in the first place – something the Seattle Times and other media outlets conceded.

Thanks to tens of thousands of Washingtonians rising up to oppose a bill that would have resulted in the largest property-tax hike in state history, the 1% annual cap for property-tax increases without voter approval remains in place.

This doesn’t prevent local governments or the state from trying to raise your property taxes to cover increased expenses, but they will have to ask the voters for permission at the ballot box. That’s how it should be. Government shouldn’t be able to increase your property taxes by 4%, 5% or even 10% without your approval.

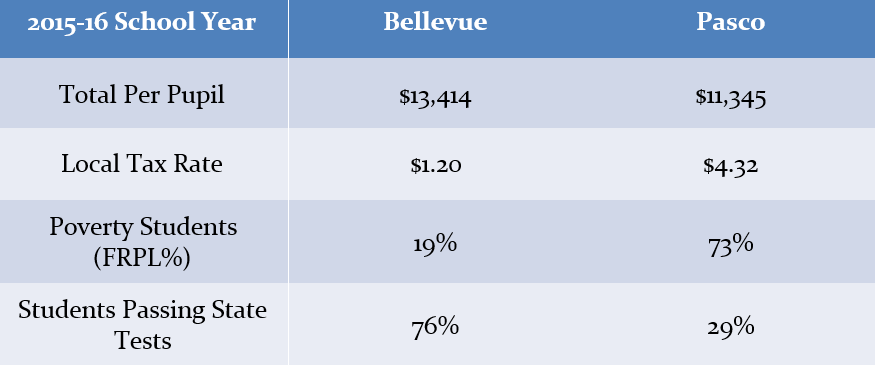

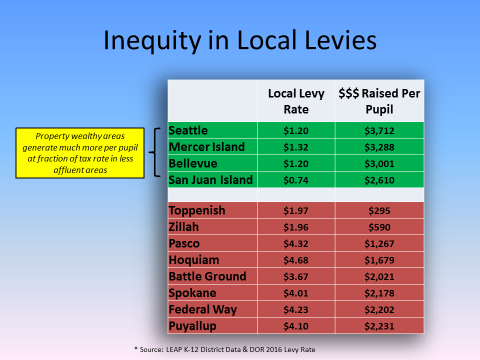

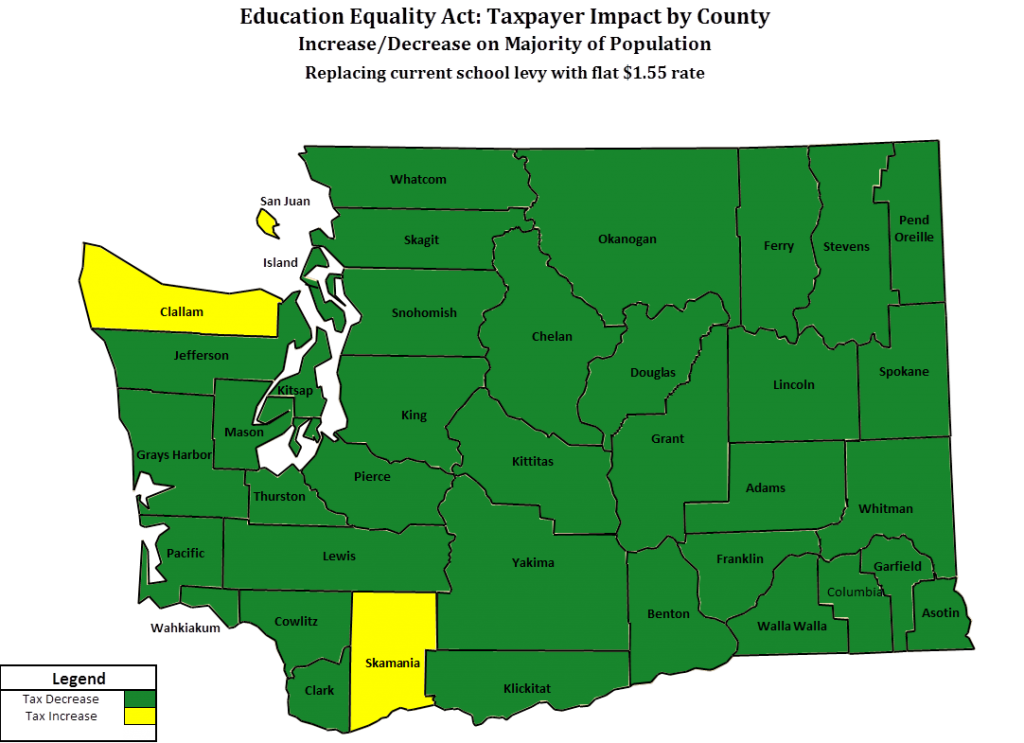

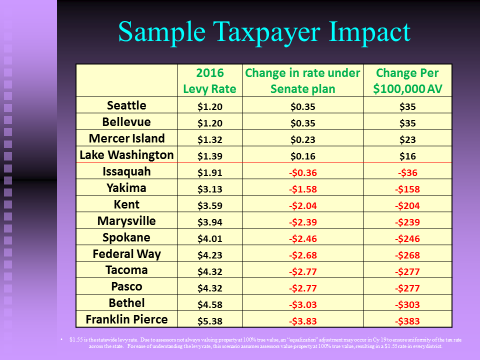

Unfortunately, the majority did lift a different cap on local school levies, which will ultimately widen the education gap between kids who live in districts with higher property values and those in areas with lower property values. Rural districts and the Latino community will suffer most.

Once again, a child’s ZIP code will affect the quality of their education – and no one should tolerate such discrimination. This means the state will likely end up back in court, being sued again (as it has been twice before) for an unconstitutional overreliance on local levies to fund K-12 education.

I’ll continue the fight against education inequity and will keep you informed on how this develops.

It continues to be an honor to serve as your Senator and fight for our shared priorities.

The 2026 session doesn’t begin until January, but you may email me at john.braun@leg.wa.gov during the interim with questions or concerns.

Sincerely,

John Braun

20th district projects in the capital budget

The state’s capital budget pays for various construction and improvement projects around the state — everything from school construction to historic restoration. The following projects in our district received funding.

Green Hill School security improvements: $4.5 million

Cascade Community Health: $541,000

Improvement to the 4-H barn at the SW Washington Fairgrounds: $767,000

City of Centralia nitrates solution project: $5 million

Austin Point recreation plan: $521,000

Downtown La Center improvements: $400,000

Pioneer Street slope stabilization: $1.5 million

Chehalis River raw water main replacement: $1.75 million

Rose Way extension: $752,000

LG Borst Park ball field lights: $1.1 million

Toutle River fish collection facility matching funds: $6.5 million

Republican wins

The following is not a full list of all the positive things Republicans accomplished this session, but it gives you a good idea of what we were up against.

A Safer Washington

- Secured $100 million to help law-enforcement agencies hire more officers

- Stopped the lowering of penalties for sex offenders (SB 5312)

- Prevented the state from having the power to decertify county sheriffs elected by the people (HB 1399)

- Kept violent felons from petitioning for resentencing, and possibly release, after serving only 10 years in prison (SB 5269)

- Preserved tighter restrictions against sex offenders caught in “net nanny” online stings (SB 5312)

An Affordable Washington

- Protected taxpayers from an additional increase in taxes of $11 billion

- Stopped the pay-per-mile tax (HB 1921/SB 5726)

- Prevented a rate change that would allow the largest property-tax increase in state history (HB 2049, in its original form)

- Made it easier to build housing through zoning reform (SB 5471)

A Better Future for Washington’s Kids

- Protected new mothers receiving Medicaid by preserving 12 months of postpartum maternity care (HB 2041)

- Prevented children from being exposed to a harmful, inappropriate far-left agenda in school (SB 5180)

- Stopped childcare from becoming even more unaffordable by stopping even more unnecessary regulation (SB 5062)

- Kept the majority from raising college tuition by $2,500

Special Mention

- Stopped the majority from killing the citizens’ initiative process by putting unreasonable requirements on signature gatherers (SB 5382)

Democrat missteps

The majority made various mistakes this session — bad bills, tone-deaf comments, and a continuing drive to undermine parents’ rights. Here some of the most notable ones.

Causing and overstating the budget shortfall

The budget shortfall was never $12 billion, $15 billion, $18 billion or $21 billion. The true gap was never more than $8 billion, according to our nonpartisan budget staff, which had no incentive to inflate the numbers to support an argument for higher taxes. But the cause was clear – years of the majority’s reckless uncontrolled overspending.

Trying to raid the “rainy-day fund”

The “rainy-day” fund (formally called the Budget Stabilization Account) is not the Democrats’ slush fund. We need to protect it for a real “rainy day” caused by a recession or other disastrous event, not to fund new pet projects and programs.

Pursuing $21 billion in new and higher taxes

Our $ave Washington budget proved that we could pay for current government programs without raising a single tax. Even though the majority ended up imposed $9.6 billion in taxes, it’s less than half what they wanted.

Undermining parents’ rights

Democrats continued to interfere in the parent-child relationship, assume parents are the enemy and expose children to damaging ideas/content.

Failing to stand by women

The majority refused to allow the Senate to vote on a resolution honoring women in sports.

Worsening the education gap

By lifting the cap on school levies, the majority has set the state up for another court battle over overreliance on local levies, which creates an unconstitutional imbalance in the education opportunities available to kids in wealthy areas compared to kids in areas with lower property values.

Giving unemployment benefits to striking workers

Taxpayers are now on the hook to pay up to six weeks of unemployment benefits to workers who have chosen to go on strike. These benefits are supposed to go to workers who become unemployed through no fault of their own.