20th District senator says Democrat colleague’s proposal

to reduce pain at pump also deserves consideration

CENTRALIA… The excessive financial windfall from Washington’s cap-and-tax policy should be used to address the affordability crisis facing the state’s homeowners and renters, says Senate Republican Leader John Braun.

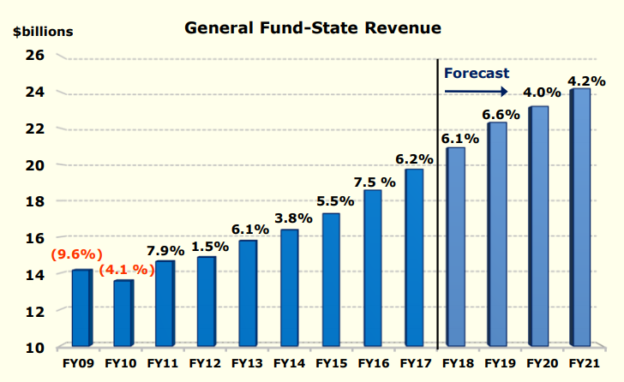

As of last month, state government had already raked in $919.5 million from the combination of quarterly and other auctions of “carbon allowances” allowed under the cap-and-tax policy – formally known as the Climate Commitment Act. The state Department of Ecology announced Wednesday that nearly 8.6 million more allowances sold at a “settlement price” of more than $63 apiece at its third-quarter auction, held Aug. 30. The exact proceeds from that auction will be announced later this month.

Under the cap-and-tax law, roughly $720 million in cap-and-tax proceeds are to be reserved for transportation purposes each fiscal biennium. Braun says the remaining auction proceeds, which could easily top $1 billion before legislators convene for their 2024 session, should be turned into financial relief for property owners and renters.

“While Republicans are determined to address our state’s affordability crisis, many on the majority side seem content to let the cost of living climb even higher,” said Braun, a Centralia resident who serves the 20th Legislative District. “The governor and majority Democrat leaders apparently believe they must discourage fossil-fuel emissions by any means available, even though their climate policy is functioning just like another one of the regressive taxes they often complain about. It’s obvious to everyone but Governor Inslee that cap-and-tax is the reason Washington has had the highest or next-to-highest gas prices since June – which are blowing up the budgets of working people and families, with low-income families hit hardest of all.

“As Democrats are clearly unwilling to join Republicans to reduce the cost of gas in our state, let’s at least bring housing costs down instead,” Braun said. “Take the excess proceeds from their cap-and-tax policy – meaning the money not promised for transportation – and commit those to providing property-tax exemptions and credits to renters, as Republicans had proposed during this year’s legislative session.

“Those who truly believe Washington’s tax system is regressive and are convinced that higher gas prices mean less consumption and therefore fewer emissions should jump at this. They can be true to their climate agenda while putting those carbon-pricing dollars to work making housing more affordable, especially for low-income people. It is inexcusable not to do this.”

Braun also voiced support for a new proposal from Sen. Mark Mullet, D-Issaquah, that is aimed at reducing the cap-and-tax policy’s inflation of Washington gas prices.

“Senator Mullet has put a thoughtful package of ideas on the table. It appears to respond to concerns I’ve heard and also is in line with some of what a group of lawmakers proposed to Ecology in July. I appreciate that he also is proposing tax relief, in the form of a temporary reduction in car-tab costs, and following through on the fuel-cost exemption that was promised but has not been delivered to our state’s agricultural and maritime industries.

“Like our housing-affordability proposal, his deserves serious consideration sooner rather than later from the leaders on his side of the aisle. We must do better.”