OLYMPIA… Another jump in price inflation at the state and national levels has Senate Republican leaders calling again for legislative action to provide financial relief to Washington families.

OLYMPIA… Another jump in price inflation at the state and national levels has Senate Republican leaders calling again for legislative action to provide financial relief to Washington families.

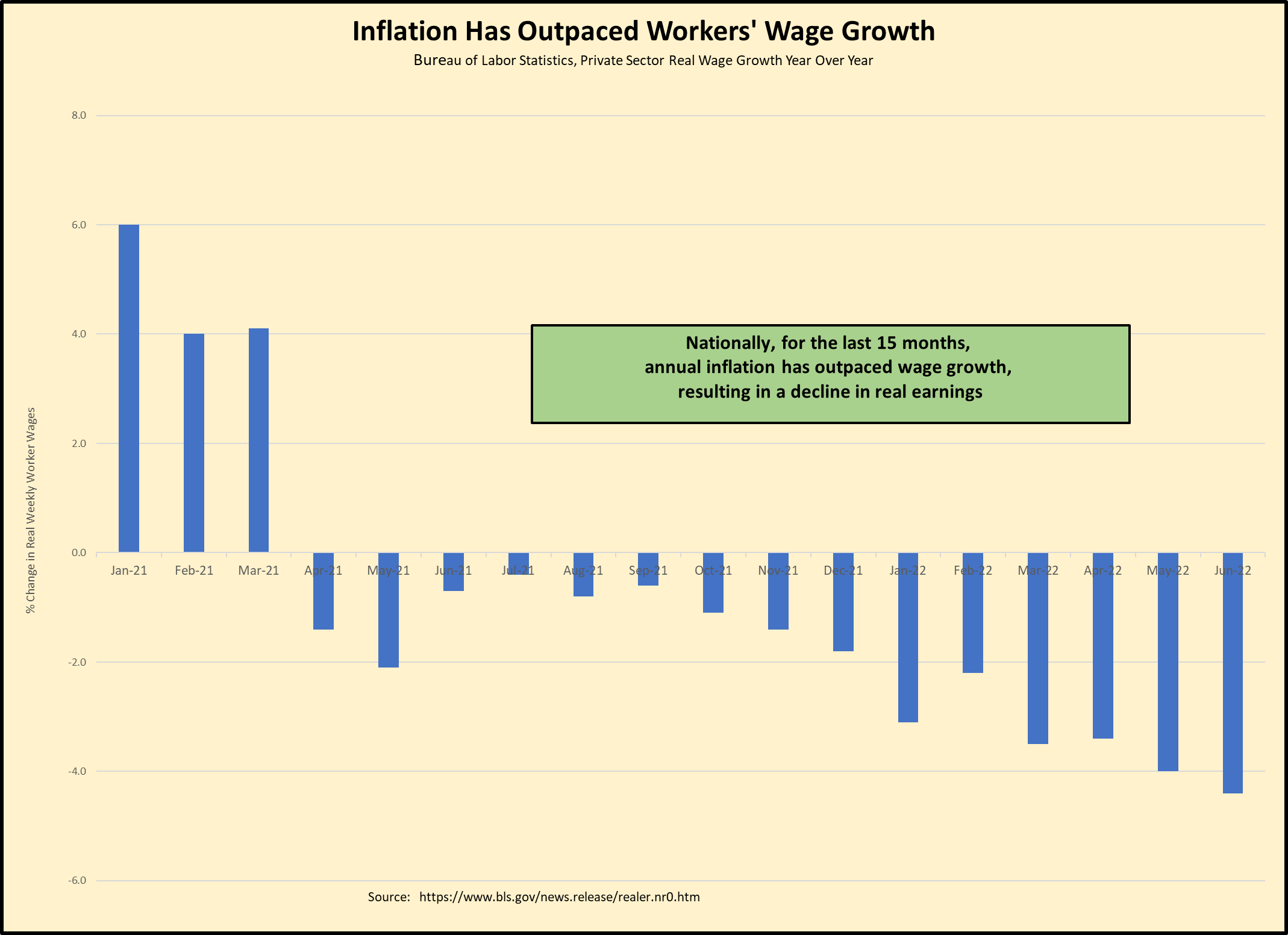

New numbers from the federal Bureau of Labor Statistics show the June inflation rate in Washington was 10.1% higher than a year earlier, a full percentage point up from two months ago. Nationally, the inflation rate was up 9.1% for the same period, the highest in 41 years and up from 8.3% two months ago.

From Senate Republican Leader John Braun, R-Centralia:

“The governor keeps rejecting any ideas for providing immediate financial relief to most families in the middle. All he will talk about is a 2023 tax credit that will be available only to some with lower incomes. It’s as though he doesn’t understand, or doesn’t care, how people at all levels in our state are being hit by what is now double-digit inflation. This new report shows they have seen their real earnings shrink for 15 consecutive months.

“The state has a mountain of cash that is continuing to grow. Our colleagues in the majority should join us to end the government greed and get more dollars back into the hands of families. It can be done without harming a single state program or service. Republicans are ready to act. Where are the Democrats? The affordability crisis in our state affects their constituents too.”

From Sen. Lynda Wilson, R-Vancouver and SRC budget leader:

“Budget leaders on the majority side seem stuck on what they call ‘targeted investments,’ which means showering more money on state agencies. The truth is, none of what they did this year to fatten state government will help the typical Washington family cope with an inflation rate that is continuing to grow, with no end in sight.

“Our Democratic colleagues don’t seem to realize that significant, direct tax relief – like a temporary suspension of the gas tax, which would let families keep more of their own money – should also be viewed as a ‘targeted investment.’ With prices up more than 10 percent that’s the best investment we could make to help Washington families. Legislators need to act.”