Governor will block hastily approved tax ‘if he’s consistent’, says budget leader

OLYMPIA… A bipartisan group of high-ranking state legislators today asked Gov. Jay Inslee to veto a new $133 million tax that came out of nowhere to zoom through the Legislature just before its annual session ended April 28.

“This was bad policy to start with, and the fact that it was hustled through in little more than 48 hours makes it even less defensible. That’s not how our state constitution intends for laws to be made,” said Sen. John Braun, Senate Republican budget leader.

Joining him in the veto request are Sen. Mark Mullet, D-Issaquah, who heads the Senate committee on banking; Senate Republican Leader Mark Schoesler of Ritzville; House Republican Leader J.T. Wilcox of Yelm; and Rep. Drew Stokesbary, R-Auburn, who is Republican leader on the House budget committee.

Inslee has until May 21 to veto House Bill 2167, which would effectively double the business-and-occupation (B&O) tax on out-of-state banks; otherwise it becomes law and takes effect July 28.

In their veto-request letter the lawmakers detail how the policy in HB 2167 wasn’t made public until the final Friday afternoon of the 2019 session, yet was through the Democrat-controlled Legislature and on its way to Inslee just two days later. Along the way it bypassed both the Senate and House committees that address policies concerning banks.

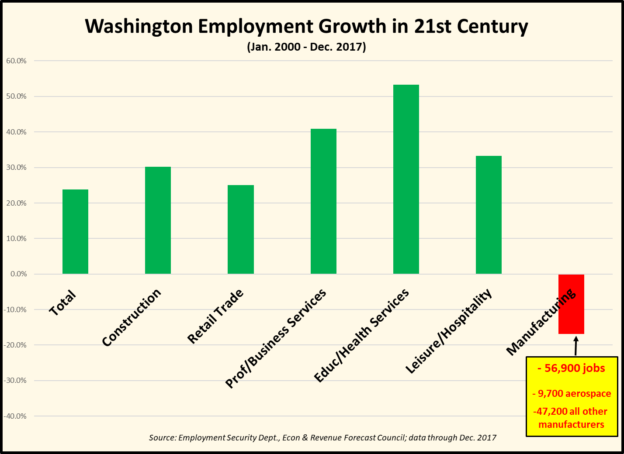

They also cite Inslee’s veto of a 2017 manufacturing tax-fairness bill that had moved rapidly through the Legislature. In his veto message the governor wrote that the “tax reductions should be considered in a thoughtful, transparent process that incorporates public input and business accountability.”

“If he’s consistent, the governor will veto this tax increase for the same reason. And in doing so he’ll also protect the taxpayers from any chance of a lawsuit on the grounds that this tax is in violation of the U.S. constitution,” said Braun, R-Centralia.

“It’s as though the majority simply wanted more money to spend and said ‘let’s go after the big banks’ without giving any consideration to the legislative process envisioned by the state constitution.”