Sen. John Braun was presented with the Legislator of the Year for Career and Technical Education award today by the Washington Business Alliance for his work to support career opportunities and skills training in the new state budget. Braun, who serves as chief budget writer in the Senate, fought for additional investments to better prepare students for an increasingly competitive workforce.

“With each passing year, today’s students and tomorrow’s employees face more diverse and competitive demands. In order to be prepared to earn good jobs, students must have the appropriate skills, whether that be through vocational training, apprenticeships, or four-year college,” said Braun, R-Centralia. “Not every student has the same career path just as the job market is not one-size-fits all. This should be reflected in how we support and prepare students.”

As part of the award presentation, local students, teachers, employers, and school district officials gathered to learn more and discuss the importance of providing multiple pathways to employment, including career and technical training.

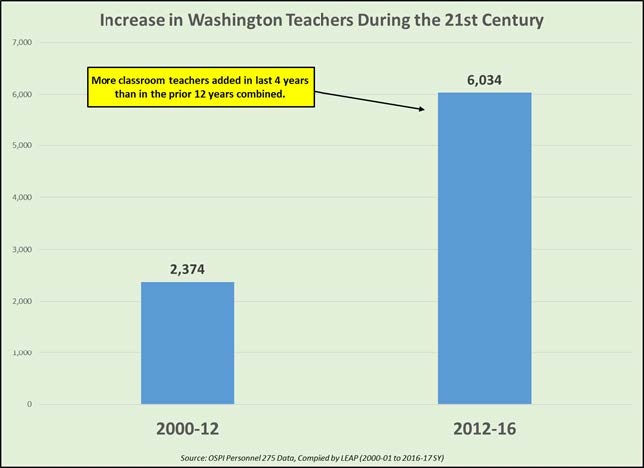

The new state budget increases investments for career and technical education by more than $200 million over the next four years. Braun was the architect of the Senate budget proposal and served on both the education and overall budget negotiating teams.

“The business community is grateful to Senator Braun for recognizing the need for a talent pipeline to the technically skilled positions industry currently struggles to fill, which are vitally important to growing our Washington economy,” said Jene Jones, education policy advisor to the Washington Business Alliance. “Senator Braun’s leadership led to landmark investments for career and technical education students statewide, and we congratulate and thank him for the lasting impact of his work.”

Career and Technical Education Washington promotes and supports middle and high school programs that provide 21st century academic and technical skills for students. Through CTE, students have the opportunity to explore career options, especially in high-demand and high-growth fields. They are encouraged to identify career goals and can take classes at skills centers and community and technical colleges that apply math, science, and other academic subjects in a real-life, hands-on way. They can also pursue a registered apprenticeship, industry certifications, and two- and four-year college options.

The new 2017-19 budget, sponsored by Braun, was approved at the end of the 2017 legislative session and went into effect on July 1st.