Repairing an Unconstitutional K-12 Funding System

Education Equality Act:

Ample, Equitable & Student-Centered

“It is the paramount duty of the state to make ample provision for the education of all children residing within its borders.” – Art. IX, Sec. 1 of the Washington State Constitution.

Bottom Line Up Front

Unconstitutional System:

Washington’s K-12 funding system is irrational and inequitable.

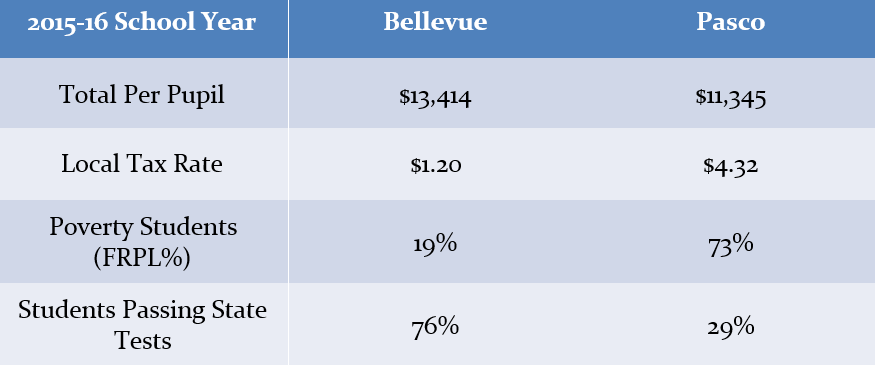

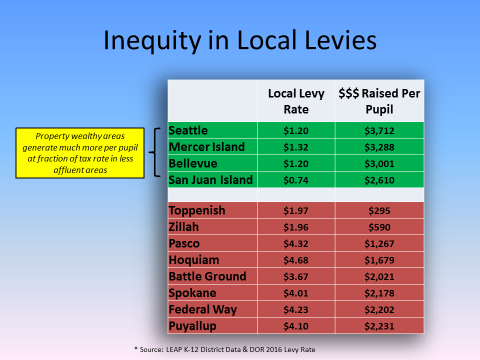

Wealthy districts receive more funding per pupil & have lower tax rates vs. less affluent areas with more challenging student needs.

This inequity is created by an unconstitutional reliance on local levies to support schools and a funding model focused on adult characteristics rather than student needs.

Solution:

The Education Equality Act ends this unconstitutional scheme with a funding model that is ample, equitable, and student-centered.

The Particulars of the Education Equality Act – A Primer (1)

Institutes a Per Pupil Funding Model

- Provides $10,000 base per pupil funding for every student.

- Additional supports for students with greater needs:

- $7,500 for special education;

- $2,000 for students in poverty ($5,000 for districts with high percentage poverty);

- $1,000 for English Language Learners;

- $1,500 for homeless students;

- doubles funding for highly capable students;

- and doubles funding for career and technical education students.

- $12,500 guarantee – Each district guaranteed to receive at least $12,500 in total funds – not counting local levies – per student. This means $250,000 per classroom of twenty students.

- Holds districts harmless so no district receives less funding than current law.

Eliminates Unconstitutional Reliance on Inequitable Local School Levies

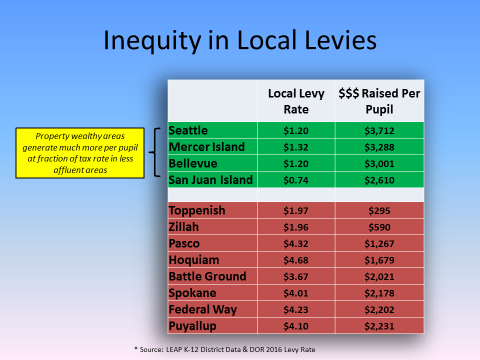

- Wealthy districts currently have higher per pupil funding and lower tax rates than high poverty districts – the opposite of an equitable system focused on the needs of all students.

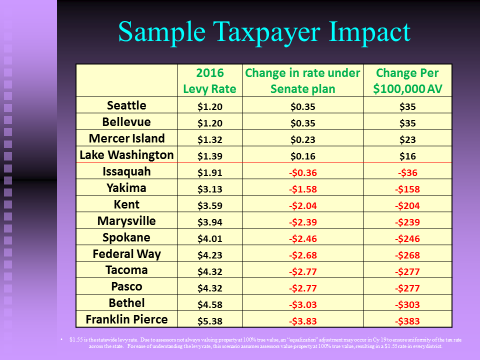

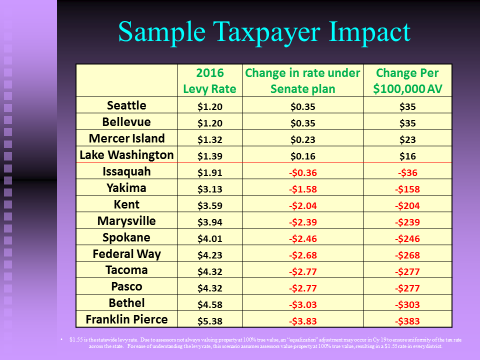

- Rates range from $1.20 per $1,000 of assessed property value in Seattle and Bellevue to over $4 in such districts as Federal Way, Bethel, Aberdeen, Pasco, Tacoma, Shelton, Spokane, Moses Lake, and Franklin Pierce ($5.38). Yet with lower poverty rates, Seattle and Bellevue have substantially higher total per-pupil funding than these other districts.

- The Education Equality Act absorbs and replaces all currently collected local levies with a single uni- form rate and prioritizes $6 billion of revenue growth toward education over the next four years.

- $1.55 rate would be substantially lower than $2.54 rate local levies currently average.

- 83% of taxpayers would see a lower tax rate than they currently pay.

Result: $1,500 per pupil average increase statewide, without any local levies

- $11,870 per pupil total funding in current school year (includes local levies).(2)

- $13,310 per pupil in 2020-21 (no local levies).(3)

- Every district receives more funds.

- Greater increases in high poverty areas: (4)

- Toppenish (48% students below census poverty line) – $2,900 increase per pupil

- Omak (27% students below census poverty line) – $3,670 increase per pupil

- Yakima (35% students below census poverty line) – $2,130 increase per pupil

- $14,430 per pupil if voters approve limited local levies. (5)

- In calendar year 2020, districts may seek voter approval for 10% levy.

The Ample, Equitable & Student-Centered Approach

I. Ample

A. K-12 makes up more than 50% of the state budget for first time in over 35 years.

The Senate budget increases state K-12 spending by $3.7 billion from the current biennium. In addition to the per pupil funding approach, the budget reduces K- 3 class size throughout the entire state from 25 to 17. (6)

The end result? K-12 is 50.7% of the state budget, a level not seen since 1981. (7)

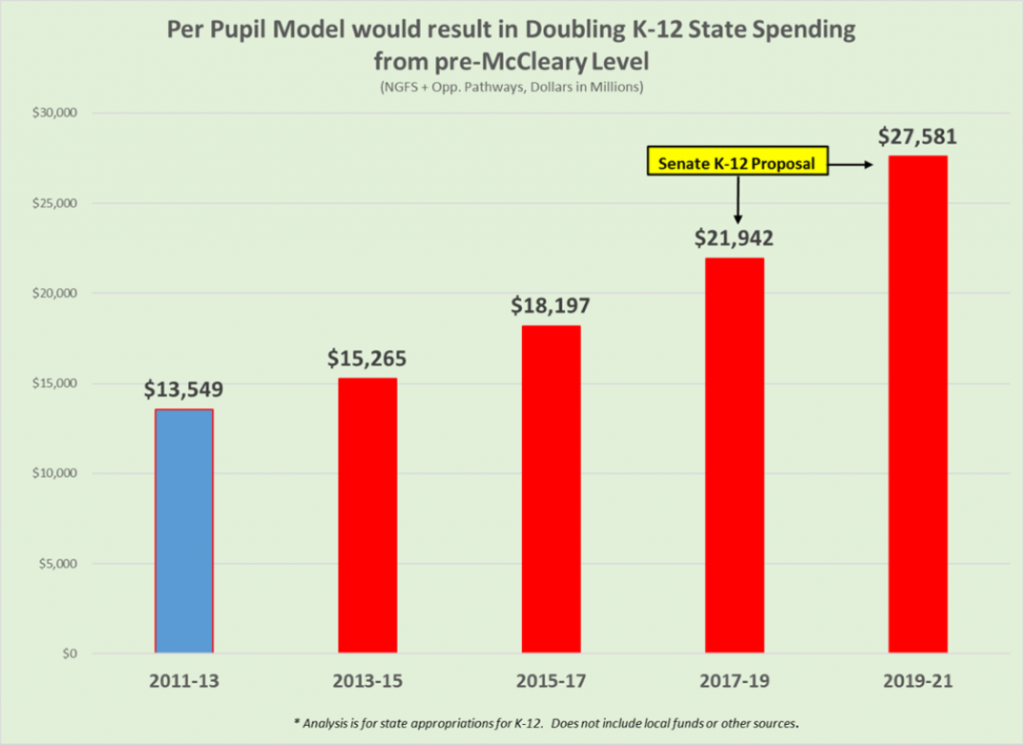

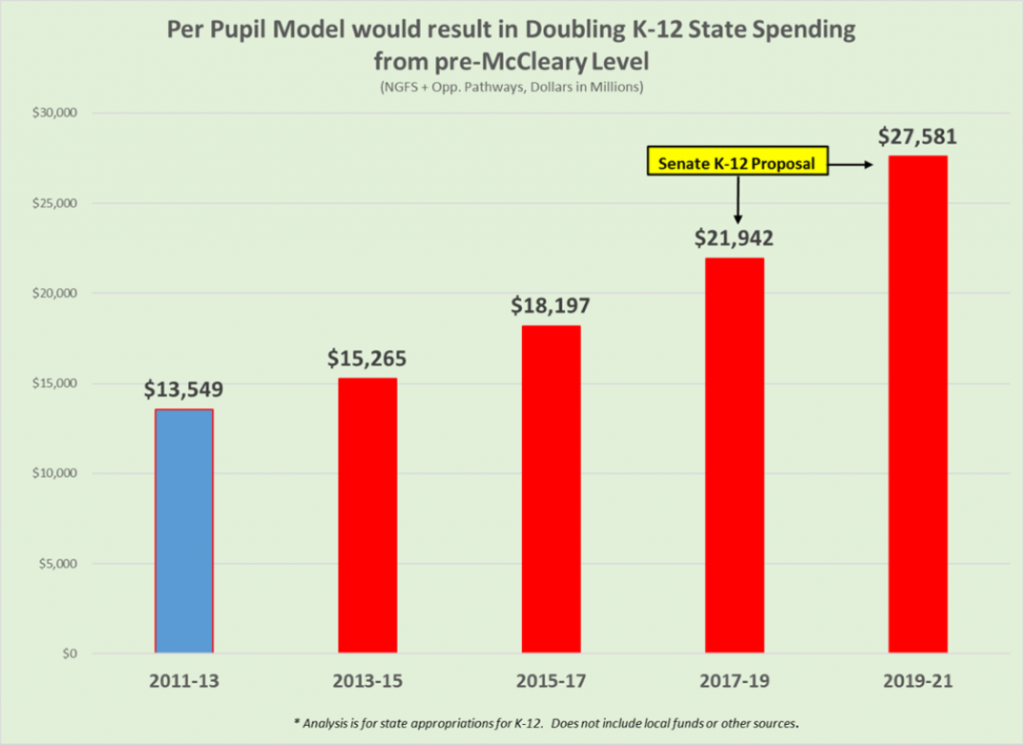

B. Doubling K-12 State Spending since McCleary ruling

In 2012, when the McCleary decision was issued, the state spent $13.5 billion on K-12 education. In 2019, the Senate proposal would spend $27.6 billion, more than doubling state funding in less than a decade. (8)

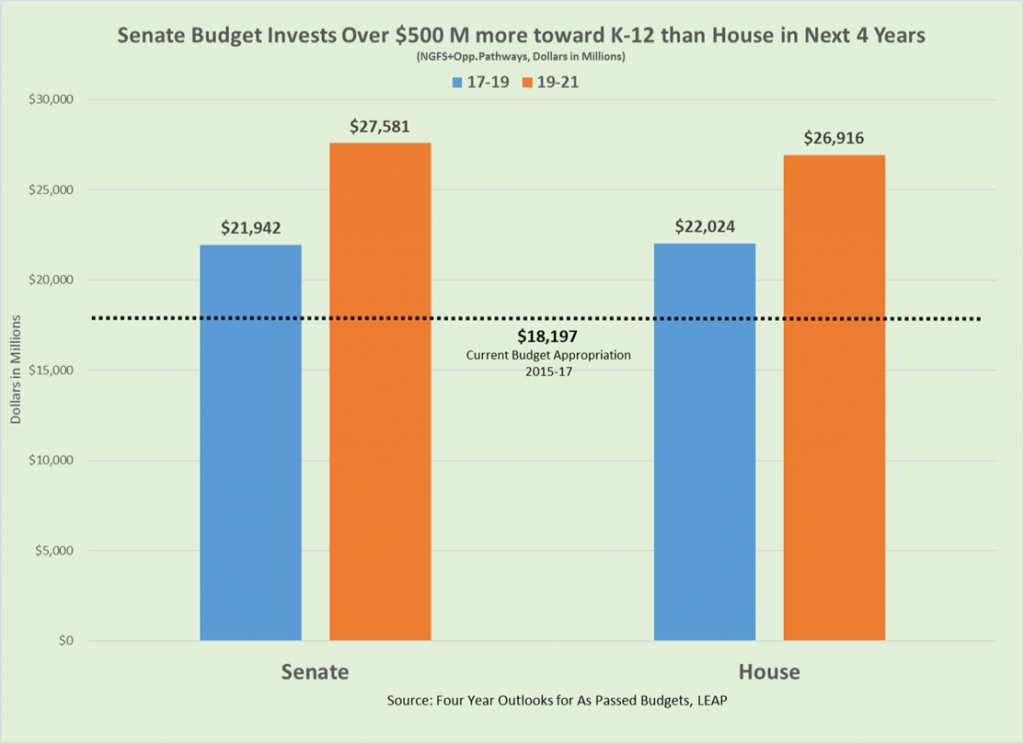

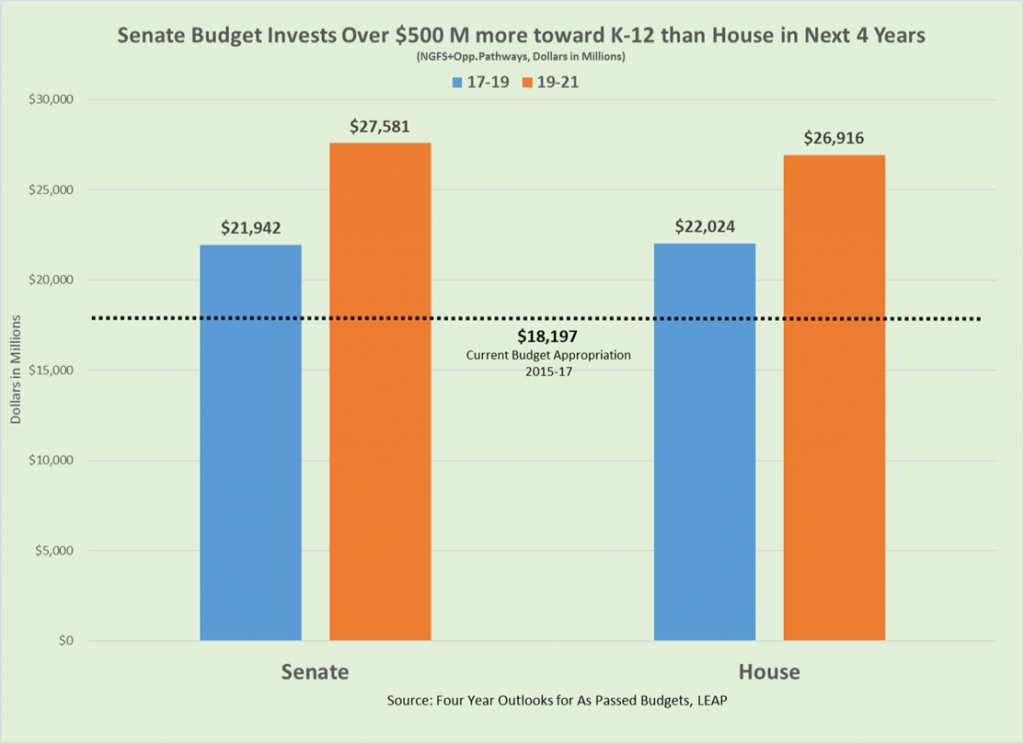

C. Senate Puts More State Funding into K-12 than House

There have been attempts to portray the House budget as better for K-12 funding than the Senate. It is important to understand this argument for what it is: entirely a debate about how much local levy authority to allow. The Senate provides more state funding than the House. But the House proposes substantially higher local levy authority, permitting districts to raise more funds than allowed by current law. This makes the current unconstitutional system worse. Local levy inequity creates huge per pupil and taxpayer inequities. Allowing even more local levy collection will perpetuate and exacerbate that unconstitutional inequity. The state Constitution is clear: it is the state’s paramount duty to fund public schools.

D. Guarantees $250,000 per classroom without any local levies

The Education Equality Act ensures every school district receives at least $250,000 in funding to educate classrooms of twenty students.

II. Equitable

“Wealthy areas have lower tax rates and higher funding per pupil than high poverty areas.”

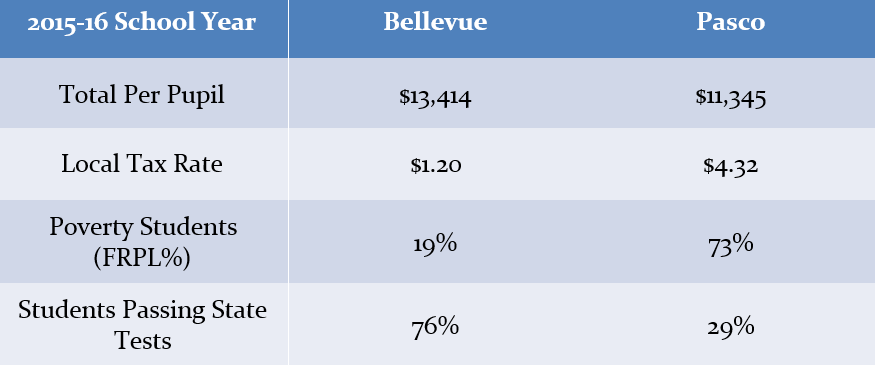

Here is an example of how our current K-12 system is inequitable: (9)

Financing a school system with too much reliance on local levies results in the unconstitutional system we have today:

- Inequitable funding rates per pupil,

- Inequitable taxpayer rates in communities, and

- Most importantly, and unsurprisingly – inequitable outcomes.

This levy-reliant system harms children in less affluent areas – asking their families to pay a higher tax rate to support schools & generating less money than wealthy areas. A double whammy; creating a downward spiral that not only underfunds schools but puts pressure on the local economy and drives rates higher.

This is precisely why the state constitution made it a requirement for the STATE to make ample provision for education. The reliance on local levies is wildly unfair.

Fixing the Inequity: Flat Uniform Rate Across State (Coupled with Per Pupil Funding Model)

The Education Equality Act absorbs and replaces all the various local levies with a uniform $1.55 rate for taxpayers across the state. Coupled with the per-pupil funding approach, this resolves both the taxpayer inequity and the funding inequity present in the current system. Equal funding will support equal opportunity for all children.

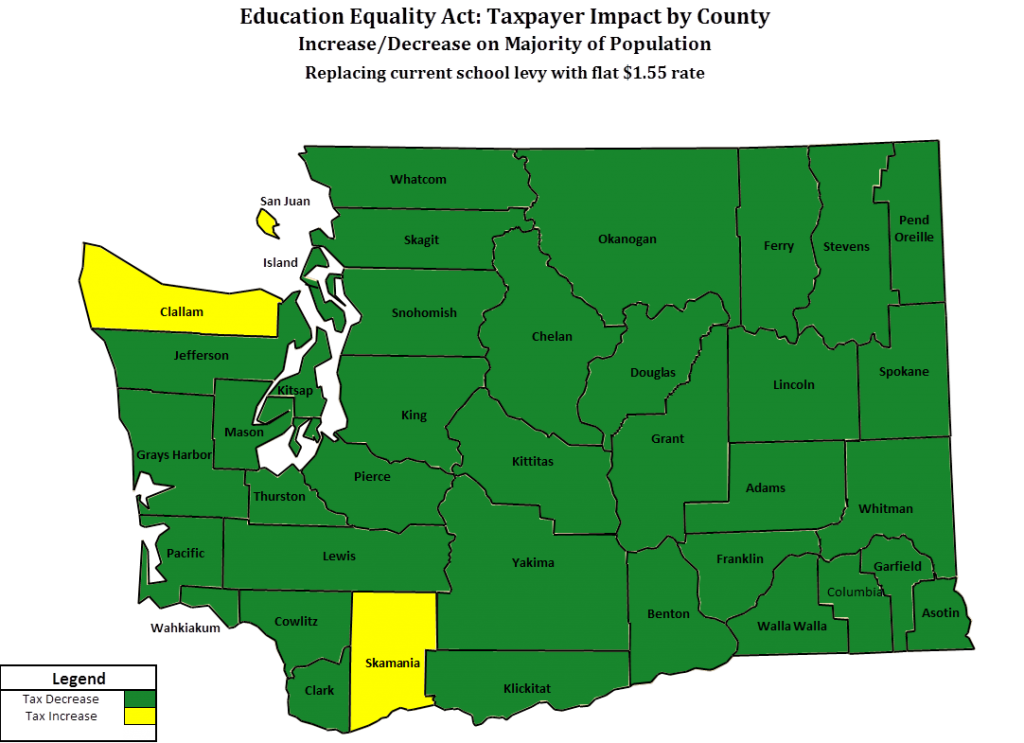

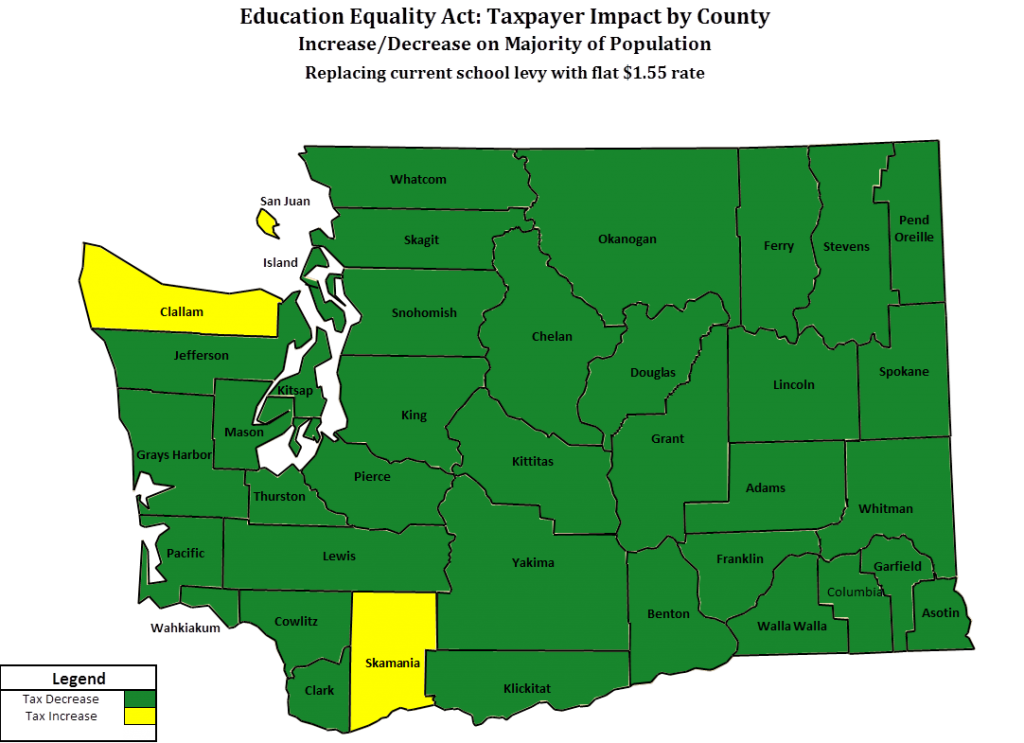

1. 83% of residents would see a tax reduction by going to a uniform $1.55 rate

Thirty-six of the thirty-nine counties would see a tax reduction for the majority of residents, including 100% of residents in large counties such as Pierce, Snohomish, Clark, and Thurston. (10)

A full breakout of the individual county impacts is attached as Appendix A.

2. King County: End Inequity of Federal Way Homeowner Paying More School Taxes on $300,000 home than Bellevue owner pays on $1 million home.

This is not a rural vs. urban issue. This is property wealthy vs. non-property wealthy.

Current law:

| Federal Way ($300,000 home) |

$4.23 levy |

$1,269 tax bill |

| Bellevue ($1 million home) |

$1.20 levy |

$1,200 tax bill |

Education Equality Act proposal:

| Federal Way ($300,000 home) |

$1.55 levy |

$465 tax bill |

| Bellevue ($1 million home) |

$1.55 levy |

$1,550 tax bill |

Only four districts in King County would see tax increase: Seattle, Bellevue, Mercer Island, and Lake Washington. The remaining 16 districts would see a tax reduction. (11)

3. Property tax increase on Wealthy Areas is Comparatively Small

A $2 million home on Mercer Island would pay $460 more a year in taxes. (While a $250,000 homeowner in Tacoma would see a $692 tax reduction.)

III. Student Centered

A. Improving Educational Opportunities & Funding for All Students

The Education Equality Act allows the Legislature to provide uniform educational funding opportunities to all students, in line with the constitution and immune to local economic conditions. It also focuses funding equally on the areas of greatest need.

Students and teachers who walk into Pasco and Yakima classrooms deserve the same amount of state sup- port for their actual and unique educational needs as students living in affluent King County communities like Medina and Mercer Island.

By establishing a guaranteed level of funding, then adding resources in certain situations, state government can enable schools in economically depressed areas to provide the same advanced-study or training opportunities for students as those schools in wealthy areas.

The Education Equality Act will enable school districts to provide for the unique needs of all students by delivering ample, dependable and equitable funding.

Accomplishing this requires repealing the existing prototypical funding model in favor of a statewide per- student funding system.

We set a $10,000 annual per-student funding amount and, recognizing that students have different needs, provide additional funding based on student characteristics, including:

- $2,000-5,000 per student from a low-income family.

- $7,500 per special-education student.

- $1,000 per English-language learner.

- $1,500 per homeless student.

- Double the state funding for highly capable students.

- Double the state funding for vocational education (career and technical education).

Districts would then be guaranteed to receive from the state a total funding amount of at least $12,500 per pupil. (12)

The Senate plan seeks to improve educational outcomes for all students, with an emphasis on bringing the lowest-performing students up to the level of high-performing students.

B. Ending Adult-Centric Funding Model that Perpetuates Funding Inequities

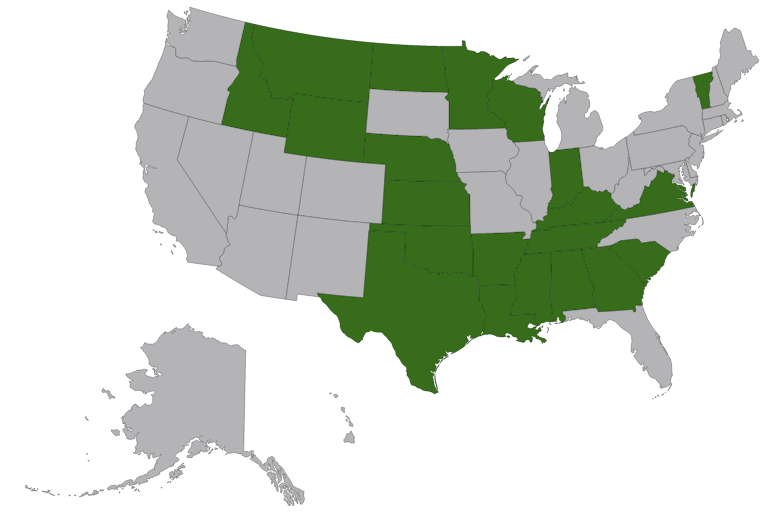

Washington is one of only seven states still using an education-funding model that experts agree creates inequities (the others being Alabama, Tennessee, West Virginia, Idaho, Wyoming and North Carolina).

Washington’s method has students with the highest needs seeing less financial support. That disconnect stems not only from the reliance on local levies but also from a little-known but incredibly important method called the “staff mix” funding formula that drives money to schools based on the years of teaching experience of the staff in a particular building, not the actual educational and socioeconomic needs of the students in that building.

A recent article from the Seattle Times Education Lab project highlighted this major flaw in the adult- centered school-funding model:

“It’s ridiculous — either inadvertently ridiculous, or deviously ridiculous,” said school-funding expert Bruce Baker, a widely honored professor at New Jersey’s Rutgers University who describes such policies as “stealth inequities.” That is, poorly designed formulas which fail to correct, and sometimes rein- force, disparities between students. “Washington perplexes me,” Baker said in an interview. “It’s a progressive state, at least by reputation. But it’s unexpectedly not good on school funding.” (13)

A better way to fund schools looks at each student, asks “what does that student need?” then delivers the right amount of funds accordingly. It is a fundamentally different way of driving educational outcomes, providing greater flexibility and ending inequities.

C. A “One Washington” Approach

The Senate-approved Education Equality Act would finally connect school funding with the actual cost of educating students – a landmark change from the status quo. By any credible measure, it represents a progressive approach for eliminating the educational-opportunity gap, and the associated social injustices, caused by inequitable differences in district-level funding.

This stands in stark contrast to proposals from the governor and House of Representatives that would in- crease funding for K-12, requiring unprecedented tax increases, yet exacerbate the inequities in the state’s outdated, adult-centered approach.

Their proposals would fail to solve the unconstitutional disparity between schools and school districts by widening the education-opportunity gap between low-income students (many of whom are of color) and students from higher-income areas.

Because it recognizes and addresses the shortcomings of the current model, the Senate proposal is the only reform available to the Legislature that would bring the state’s K-12 system into line with the “uniform” and “without preference” requirements of the state constitution and offer a truly “One Washington” approach to education.

The Education Equality Act is:

- Ample – Providing more state funding for K-12 than the House;

- Equitable – Ending the student funding & taxpayer inequities caused by relying on local levies to fund schools; and

- Student-Centered – Enacting a per pupil funding model focused on students and their needs.