Another example of how the government thinks it can spend your money more wisely than you can

Did you notice recently that the state of Washington deducted an additional 0.58% of your paycheck? This is to fund what the Democrats are calling “Washington Cares,” which is a state-administered long-term care program that has some serious flaws. More people are speaking out against it since they see it as another example of how the government thinks it can spend your money more wisely than you can.

My office has received calls and emails with questions about the program. I wanted to answer some of them here.

Read more about why the long-term care tax is a disaster.

Q: I have a private long-term care policy, but I didn’t realize that I needed an exemption from the Employment Security Department. Can I apply for the exemption now?

A: The exemption window for a having private coverage expired on 12/31/22. A worker wouldn’t be eligible to opt out unless they happen to meet one of the other limited exemptions listed here:

- 70% Disabled Vet

- Active duty military spouse

- Non-immigrant resident visa holder

- Live outside of Washington.

Q: Will there be another opportunity to purchase a private long-term care policy and opt out?

A: Not unless legislation passes to reopen the opt-out window. I recently announced the only proposal to create a new, permanent opt-out opportunity. Many of my colleagues are exploring the option to repeal the program. And others are looking at ways to replace it with something that has more flexibility for you. I support any options that would provide people of the state with more personal choice.

Q: I don’t plan to retire in Washington state. Will I be able to take the benefits with me?

A: No. The benefits for the program are not portable. Regardless of how long you work in Washington state, or how much money you end up contributing to the program, you lose any access to the benefits if you move out of state. If this program is to continue, that flaw must be fixed.

Q: I have retired from my career and have gone back to work part-time. Do I have to pay into the program?

A: Yes. The tax applies to all wages, even if you will never be able to take advantage of the benefits.

Q: What do I get for my money if I need to use the benefits?

A: Generally speaking, after you pay into the program for 10 years (or three of the previous six years), you would be eligible to tap into the lifetime maximum benefit, which is only $36,5000 and But that can only be used if you stay here in Washington. This amount is significantly lower than the actual costs of long-term care, which can reach $10,000 to $15,000 a month.

Contact me if you have additional questions about the program

advertised as “Washington Cares.” Or learn more about it online.

Republican letter to Hobbs and Ferguson: Investigate anti-Democracy intimidation and harassment

Republican legislators recently wrote a letter to Secretary of State Hobbs and Attorney General Ferguson asking them to look into reports that members of the Democrat Party here in Washington were intimidating and harassing people who might want to sign the petition for Referendum 101, which would have repealed a controversial law that compromises parents’ rights.

Reports of the incidents were first made public by Brandi Kruse on her podcast “unDivided” and in a letter she wrote to Sec. Hobbs. Regardless of the topic of any potential ballot measure, the referendum and initiative process here in Washington is democracy in action. Our request was based only on the concern that this process was being threatened.

This week, we received a response from Sec. Hobbs, who is also concerned about the reported incidents. In part, Sec. Hobbs says, “My office’s roles in administering elections do not include authority to investigate or enforce suspected violations of RCW 29A.84.250 (4). Additionally, the Legislature has not allocated funding to this office to create an investigative role.”

I would support legislation that provides the Secretary of State’s office with the authority and resources to investigate suspected violations. And I hope the attention this issue receives will prevent similar activity in the future. If we also receive a response from the attorney general, I will share that with you as well.

Listen to my interview on the Lars Larson Show

Inslee’s denial of the real cause for highest gas prices in U.S.

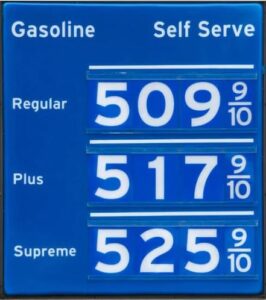

Under increasing pressure from the public, Gov. Inslee held a press conference recently to deny that his new “Cap and Invest” program, which should be called “Cap and Tax,” has had anything to do with skyrocketing gas prices here in Washington. He and several legislators said that we needed “radical transparency” to combat price gouging by the oil companies. He spread misinformation by blaming a pipeline closure that has been shown to have been immaterial. And he said he and Democrat legislators would look to California for inspiration on legislation to sponsor in 2024.

He also told us before that the program would only increase gas prices by “pennies.” Now we have the highest gas prices in the nation. Are we to believe his claims now? No.

The news conference was an attempt to scapegoat the oil industry. It is completely unrealistic to assume the oil companies would just absorb the hit from the governor’s tax. The simple truth is that companies pass increases in their overhead on to their customers through higher prices – just as small business and gig workers pass along increased costs from other taxes and regulations to their customers in the form of higher prices. If the oil companies really wanted to cash in, why would they choose to do so in Washington over the dozen other states that have higher populations? It’s nonsense.

The reality is that gas prices rose to historically high levels in Washington at the same time the “Cap and Tax” program began. Any new proposals that don’t deal with this program won’t bring down fuel prices. Arguments to the contrary are only meant to distract the people from the core issue – Washington’s Climate Commitment Act is the cause of the highest gas prices in the nation and is disproportionately affecting those with lower incomes.

It’s been clear for many years that Democrats push for policies that make fossil fuels more expensive as a way of forcing the people to change their behavior and not drive as much or to switch to expensive electric vehicles. It’s a similar concept to the soda tax, which they claimed was necessary to motivate people to drink less soda. They use taxes to manipulate public behavior.

What I hope is now clear to Democrats is that the so-called ‘polluters’ suffering most from their policy are hard-working people and businesses who rely on their vehicles and can’t afford alternatives – or reasonable alternatives that are not yet available. Working people are angry. And they have every right to be.

Rural areas are burdened more than others, since rural residents have to drive longer distances, even for basic services, and farmers can’t increase prices to account for the huge increase in fuel costs to run their equipment. Policies like “Cap and Tax” threaten the survival of rural communities and farms, and the governor is either oblivious to this threat or does not care.

What are your thoughts on this?

Contact the governor’s office at 360-902-4111 or my office

at the phone number or email address below.