Largest tax increase in Washington state history

Dear Friends and Neighbors,

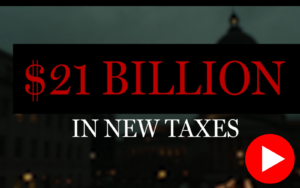

As Washington faces the largest tax increase in state history, I wanted to explain the worst ones to you here.

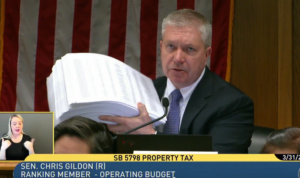

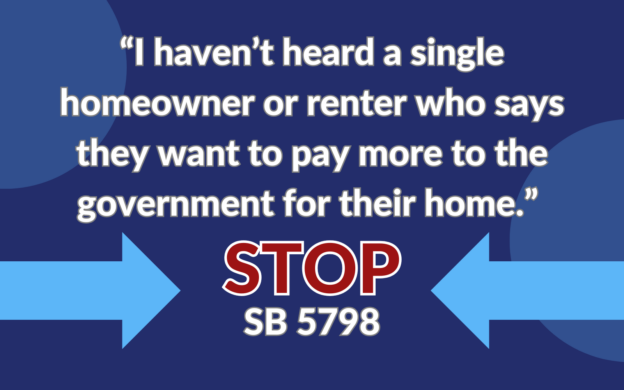

Senate Bill 5798 would remove the 1% cap on the annual rate at which state and local governments can increase property taxes without voter approval. A similar bill in 2024 proposed tripling the cap to 3%, but SB 5798 goes even further—tying increases only to inflation and population growth, with no limit, which could result in annual hikes far exceeding 3%.

Local governments support the bill because it would let them collect more money. However, current law already allows them to exceed the 1% cap, if their voters approve — a fact not advertised by the bill’s advocates.

This policy would blow the doors off everyone’s property taxes. Had this been in effect over the past decade, Washingtonians would be paying double what they pay now. If the state or local governments want to raise property taxes beyond the 1% cap, they can already do that—they just need voter approval. That’s a critical check against excessive government growth. I’m opposed to this effort to bypass the will of the people to take more of their money.

Washington is in the middle of a housing crisis. Homeowners and renters alike are worried about rising costs pushing them out of their homes. Larger annual property-tax hikes under this policy could lead to more foreclosures and evictions. It would also force many homeowners to sell, increasing demand for rental housing and driving rents even higher.

Renters often think policies affecting property owners won’t touch them, but that’s not true. Landlords will have to pass tax increases on to their tenants. And if the Democrats also succeed in imposing rent control on our state , many rental-property owners—unable to recover their losses—will sell, taking those homes off the rental market permanently.

Everyone should be concerned about this bill. If both state and local governments fully exercise the authority granted under SB 5798, property taxes could rise by 8% or more each year. The compounding effect of this tax policy over multiple years will result in billions of dollars in new property tax.

Sincerely,

Sen. John Braun

Hearing set Monday for Democrat-sponsored bill to remove 1% cap,

allow steeper annual property-tax increases without voter approval

Sign in CON, testify, and/or submit written testimony in the 4:00 p.m. hearing of the Senate’s budget committee. If you plan to attend in person, it will be held in Senate Hearing Room 4, which is in the John A. Cherberg building on the Capitol Campus in Olympia.

If you would like to sign in CON online, you can do by clicking on the following links. Remote testimony is also available.

SB 5798 – Tax on Your Home

SB 5796 – Tax on Jobs

SB 5797 – Tax on Innovation

Listen to my podcast:

A closer look at Democrat tax proposals

In my podcast this week I go into a deeper discussion about the various taxes included in the Democrat tax proposal, which would be the largest tax increase in state history.

The Democrat “wealth tax” is really a tax on innovation and will drive our largest job creators out of Washington. A similar tax has been repealed in other countries and states where it’s been tried because it was a failure. And it will be bad for Washington too.

The “payroll tax,” which is a tax on jobs, was tried in Seattle and caused the city to lose tens of thousands of jobs. The Democrat mayor of Seattle, Bruce Harrell, opposes a state jobs tax because of how it hurt Seattle economically.

Worst is the increase in the annual rate at which the state and local governments can increase your property taxes without your approval. If government needs more of your money beyond a 1% increase to cover expenses, they can already raise your property taxes more than 1%, but they must get voter approval.

This tax increase could quickly grow property taxes to more than $1 billion a year out of your pocket.

Democrats would take away your ability to vote on large tax increases.

Learn more at taxmadness.com.

Charging you more to enjoy the outdoors

Senate Democrats this week passed a bill (Senate Bill 5583) that would increase the cost of hunting and fishing licenses by 38%.

All Republican senators voted “no.” This bill, along with one to increase the cost of using state parks by raising the price of the Discover Pass and another one that would add an 11% sales tax to firearms and ammunition, would continue to chip away at your ability to enjoy the outdoors in our beautiful state.

I hope SB 5583 can be stopped in the House.

You can tell the Chair of the House Committee on Agriculture and Natural Resources to let the bill die.