Dear Friends and Neighbors,

Recently, The Seattle Times published an editorial that sheds light on why my bill (Senate Bill 5278) to address the dangerous overcrowding at Green Hill School failed to become law—even though it passed the Senate unanimously. I encourage you to read the piece, but I want to briefly explain the issue here.

As many of you know, Green Hill has long faced serious problems: assaults, riots, drug smuggling, overdoses, and sexual misconduct. These conditions have made it impossible for residents to receive the treatment and services the state is obligated to provide—services that are critical to helping them rebuild their lives and reenter society.

One of the main causes of this crisis is a law that allows individuals who committed crimes before age 18 to remain in juvenile facilities until the age of 25. Had they been just a few months older, they would have entered the adult system instead. Unfortunately, the Department of Children, Youth and Families (DCYF), which oversees Green Hill, does not have the authority to transfer these individuals to Department of Corrections (DOC) facilities—even once they become adults.

That’s where my bill came in. SB 5278 would have allowed for the transfer of certain offenders over the age of 18 into more appropriate DOC placements. The goal was to relieve pressure on Green Hill, improve safety for residents and staff, and restore the facility’s ability to provide rehabilitation and treatment.

The Senate agreed. Every member, Republican and Democrat, voted yes.

But SB 5278 was ultimately halted in the House of Representatives. The session ended without action—without relief for the youth and staff who urgently need it.

Read the statement I released when this occurred.

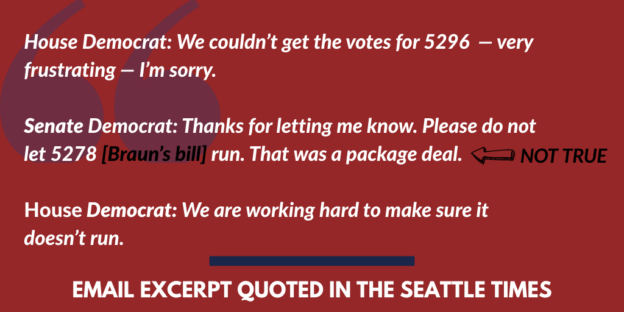

After the session, The Seattle Times submitted a public records request seeking communications between House leadership and the sponsor of a separate bill (Senate Bill 5296) that proposed sentencing reforms for juvenile offenders. While my bill aimed to solve a pressing problem by relocating violent adult inmates, the SB 5296 focused on changing how young people are sentenced in the future.

The Times reported that internal correspondence suggested the two bills were linked as a “package,” even though they addressed different issues and timelines—and were never tied together in any way. This falsehood was used to justify preventing my bill from moving forward.

This violated the public trust.

I’m disappointed by how it played out, but I’m not giving up.

I will reintroduce my bill in the upcoming session and continue working to bring meaningful reform to our juvenile justice system. Green Hill can—and must—be made safer for the youth housed there and the dedicated staff who show up every day to help them succeed.

Thank you for the opportunity to serve. I’ll keep you updated.

Sincerely,

Senator John Braun

A closer look:

Where’s all the “Climate Commitment Act” money going?

The operating budget passed by the Legislature this past session for the 2025-27 biennium spends $174 million dollars collected through the “Climate Commitment Act,” supposedly to improve Washington’s environment.

Where is that money going?

The Washington Policy Center has been tracking these expenditures and reporting them on its website. If you take a look, you’ll find:

- Washington state has collected nearly $4 billion in C02 taxes since the “CCA” took effect in 2023.

- More than 70% of the money goes toward increasing government bureaucracy, including hiring government employees and paying for studies.

- Only 9% of the $174 million in the operating budget goes toward actual “environmental projects.”

- Despite the former governor using asthmatic children as a messaging tool to promote the “CCA,” less than 0.2% of the spending goes toward reducing childhood asthma.

The following excerpt from the WPC website explains the problem further:

“Supporters of these expenditures will argue that government overhead is necessary to manage programs that help achieve Washington’s climate goals. However, that has been the approach for two decades and the state has consistently failed not only to meet its CO2 targets but even to reduce emissions. The state has spent billions of dollars on government programs and bureaucracy, always with the promise that results will follow at some point in the future.”

The capital budget also includes money earmarked for climate projects. I encourage you to visit the website again in the future to see the WPC’s analysis of how that money is being spent as well.

You deserve to know.

Instead of failing our children, focus on making their lives better

The following is an opening excerpt from my most recent commentary in The Chronicle. Read the full commentary.

In November 2020, about eight months into the COVID-19 pandemic, I called attention to how classroom closures were causing academic, emotional and social harm to the majority of K-12 students across our state — especially those from lower-income families, and children with special educational needs.

The 2020-21 school year was only about two months along, yet there were already obvious signs that the state’s remote-learning approach was failing our children both “literally and figuratively,” as I put it in a policy paper shared with my fellow legislators and the news media at that time.

While most classrooms eventually reopened the following spring, the damage had already been done. That could and should have been the low point for our state’s children. Yet the failures have continued in the nearly five years since, and in more ways.

LISTEN to my most recent podcast…