Dear Friends and Neighbors,

Parents’ rights are still under attack in Olympia. Both the House and Senate versions of a bill to undo much of the Parents’ Rights Act – created less than a year ago through the bipartisan passage of Initiative 2081 – continue to advance through the legislative process.

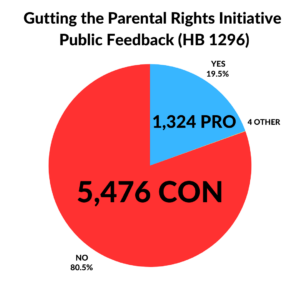

House Bill 1296 received a public hearing Thursday in the Senate Committee on Early Learning and K-12 Education. The testimony by concerned parents was compelling. Listen to the strong arguments made and notice the disrespect shown to some of those testifying against the bill.

As pointed out in an article in The Chronicle, HB 1296 “modifies 15 rights spelled out for parents in Initiative 2081 and gets rid of three rights for parents concerning medical service and treatment.”

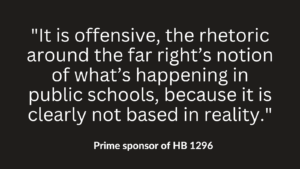

As people across the state push back against the effort to gut the Parents’ Rights Act, Democrat legislators dismiss their concerns and the concerns of educators who also oppose HB 1296 and the Senate version (SB 5181).

The president of the Eatonville School Board is worried that gutting parents’ rights will undermine the trust the schools have worked hard to earn through increased cooperation and transparency. She said that the district has lost 40 students so far just since HB 1296 was introduced.

She and others are worried that more parents will pull their kids from public schools if the bill passes.

What are your thoughts on this issue? What do you think will be the effect of dismantling the Parents’ Rights Act?

You can send your answers to my office. Keep in mind that anything that is emailed to me becomes a public record. Do not share any personal information in the email that you would want kept private.

Sincerely,

Sen. John Braun

Don’t gaslight concerned parents

Parents’ concerns about their right to know what is going on with their child are justified. That’s reality.

Proponents of HB 1296 have said that the policy will balance students’ and parents’ rights to make sure that vulnerable populations have certain protections.

Protections from what? Apparently, their parents.

Proponents of HB 1296 say that kids might be in danger of being abused or neglected by their parents if the information being held back is revealed.

That is a rare situation, not the norm. Most parents are loving and will provide the right care or support for their children. By not being transparent with parents, the school is interfering. Sometimes, that approach allows a child’s mental illness or medical needs to go untreated. It can even prolong victimization of children.

The news stories listed below are all tragic examples of how school is not necessarily the “safe space” supporters of HB 1296 pretend it is, and school officials are not necessarily acting in kids’ best interests.

- FOX 13: Police: Northshore school teacher arrested for attempted child rape

- Olympian: Former Olympia teacher accused of molesting student avoids prison by accepting plea deal

- MyNW: WA high school teacher charged with sex crimes involving young children

- TIMES: Chief Sealth High School principal resigns after arrest

- TIMES: Ex-Sumner High coach found guilty of sexually abusing players

- KIRO: Ex-tutor charged with sexually assaulting a 13-year-old student pleads not guilty

The alleged rapist in the first story listed above was caught by police during a sting that targets online sexual predators. Everyone is grateful that he was caught.

However, the chair of the Senate Committee for Early Learning and K-12 Education has sponsored a bill this year to reduce the penalties for people caught through this kind of online sting operation. This same committee was the one that just held a hearing on HB 1296 and had previously passed the Senate version (SB 5181), bills that strip rights from parents.

The committee chair’s bill would have reduced the length of time the predators would have to remain on the sex-offender registry after reentering the community.

Her inspiration for the bill was a man who was arrested in an online sting where he thought he was making a deal with a mom to have sex with her children.

Reducing sentences for people like him is the last thing the Legislature should be doing.

Senate Democrats’ ongoing effort to raise property taxes goes from bad to worse

The following is my latest column in The Chronicle.

Despite all their talk about forcing the wealthy in our state to pay more taxes, Olympia’s majority Democrats seem to have no problem forcing others to pay more as well.

The proposals in the record-breaking $20 billion tax package made public March 20 by Senate Democrats include new legislation that would allow dramatic and unpredictable increases in state and local property-tax rates.

If passed, Senate Bill 5798 would affect nearly every property owner in the state — not just wealthy Washingtonians.

In February 2024, for the second time in as many years, Democrats attempted to lift the long-standing 1% cap on the growth of state and local property taxes.

Their bill would have tripled the rate of growth allowed each year without voter approval. But with members of the public applying pressure from outside Olympia and Republican senators openly preparing for a fight on the floor of the Senate chamber, its Democrat supporters gave up.

We didn’t think this defeat would cause Democrats to give up completely on the idea of replacing the 1% cap, which dated to the passage of Initiative 747 all the way back in 2001.

We were right. They introduced the same legislation again this year, as House Bill 1334. That proposal has been sitting in a House committee for nearly six weeks; it could begin moving at any time.

But Senate Democrats are no longer looking to merely replace the 1% cap. The new proposal, SB 5798, would do away with any cap on “councilmanic” property-tax increases and instead tie the property-tax rate to inflation plus population growth.

Had that formula been in place in 2023, the rate could have increased that year by 6.74%, simply through a vote of the local council or commission. Last year the rate could have gone up again by 4.68% without voter approval.

In 2024 it was estimated that going to a 3% cap would cost Washingtonians $12 billion more over 10 years. A longer look back at the combination of inflation and population growth in our state suggests an annual increase of 4.5% — meaning for property owners, the Democrats’ new tax policy is a case of going from bad to worse.

In December, the Senate Democrats made it very clear that they intended to go after Washington’s wealthy residents for more money. They even described people with wealth as villains.

We heard it again when they rolled out their massive tax package yesterday. They described how their plan is “asking the wealthiest among us to finally do their part and pay what they owe.”

How, then, did everyday property owners also end up being targeted? Are Democrats delivering one message to one audience and a completely opposite message to another?

Achieving the American dream of homeownership is not enough to qualify someone as wealthy, but our Democratic colleagues seem to think it is — at least when taxes are involved.

The $20 billion tax package also contains another try at what Senate Democrats call a wealth tax. It’s one of the “mega-taxes” I mentioned in this space in February.

In truth, Senate Bill 5797 is a new kind of property tax — but instead of taxing people for owning land, it would tax people for simply owning a certain volume of stocks, bonds and other intangible assets.

Like the capital-gains tax that Democrats have already tried to apply to more people, this tax on unrealized gains on intangibles is also based on a threshold that could easily be lowered to snare more Washingtonians at any time. History shows taxes on the so-called wealthy always find their way to hit middle-income families as well.

A second mega-tax in the Senate majority’s tax package is SB 5796, which would basically mimic the payroll tax already being imposed by the city of Seattle. This new tax would be applied to nearly 5,300 Washington employers: the tech industry, professional services, finance, real estate and health care. Will businesses remain in Washington if we continue to tax them even more?

All of those taxes are damaging, but neither the mega-taxes nor the 20 other smaller tax increases in the Democrats’ package pose as much of a threat to lower- and middle-income families as the majority’s effort to increase property taxes.

That’s not true only for families who own homes. Property taxes also affect the cost of rent. If Democrats succeed in adding Washington to the very short list of states that impose rent control, it’s easy to imagine how housing providers might choose to get out of the market if they can’t raise rent enough to cover higher property taxes on top of other operating expenses. Every rental that would be sold, as a result, would be another rental made unavailable to people who are desperate for more affordable housing.

Washington has an acute shortage of affordable housing as it is. Allowing property taxes to grow at a rate two, three, five times more than today’s predictable 1% could mean higher rent prices, less supply or both. That would only make the shortage more acute.

Keep in mind that Senate Democrats introduced this unprecedented package of taxes more than a week after Senate Republicans unveiled our no-new-taxes, no-cuts $ave Washington budget. The majority had ample time to see how we avoided tax increases entirely, yet it went $20 billion in the other direction.

I suspect Sen. Nikki Torres, our assistant leader on the operating budget, got it right when she suggested the Democrats have wanted tax increases like these for years, and are using the budget shortfall as a convenient new excuse to try for them again.

Whatever the reason, $20 billion in additional taxes is the wrong direction for our state.

Democrats’ budget and tax plans would “stiff” state employees after all

Since before the legislative session, Democrat leaders have been telling the press and the public that to take away the 5% pay raises state employees were promised through collective bargaining with the former governor would be “stiffing” them.

However, the chair of the Senate budget committee introduced a bill this week that would completely negate the 5% raise by simultaneously cutting state employee salaries by 5%.

During the first year, state employees would see part of their negotiated raise — 3%. They would also see their salaries cut by 5%, resulting in a 2% net loss the first year.

In year two, the employees would get the additional 2%.

After all that maneuvering, they end up right where they started.

If state employees knew how they’d actually fare under the Democrats’ plan, they’d probably choose the $5,000 bonus in our $ave Washington budget proposal instead.

At least they’d come out ahead and wouldn’t have their salaries cut at all.

Those making $80,000 or less would definitely prefer the bonus since it benefits them even more than a raise, while the percentage-based raises would benefit most those at the highest end of the pay scale.

We know taxpayers would prefer for state employees to get the bonus, because the alternative has too steep a pricetag. Imagine paying billions in new and higher taxes to fund raises that will result in a net loss.

How is that better for state workers? It’s not. The Republican budget is better for state workers.I sat down with the Senate Republican budget lead,Chris Gildon, to talk about the unbelievable tax package the Democrats rolled out this week. It would raise taxes by nearly $20 billion over four years. Listen to why this is bad for you, bad for your neighbor, and bad for all of Washington.

Listen: Podcast on taxes

I sat down with the Senate Republican budget lead, Chris Gildon, to talk about the unbelievable tax package the Democrats rolled out this week. It would raise taxes by nearly $20 billion over four years. Listen to why this is bad for you, bad for your neighbor, and bad for all of Washington.