Dear Friends and Neighbors,

The primary reason for Washington state government’s multibillion-dollar budget shortfall is years of overspending by majority Democrats. This is a bipartisan belief. Our new Democrat governor said as much during his recent press conference, during which he also vowed not to sign any budget that does not meet certain criteria. (See below.)

Governor Ferguson drew a line in the sand, telling legislators once again he doesn’t support untested taxes. He also said that this is not the year for new spending, no matter how much it’s desired. This is a more common-sense approach to the state budget than Republicans saw from his predecessor, and it’s an approach we wholeheartedly support.

However, we encourage the governor to also take a stand against the limitless property-tax increase in Senate Bill 5798. This is the bill that would remove any cap on how much state and local governments can raise your property-tax rates each year without voter approval. Inflation and population growth would be the factors determining the allowable rate each year, under the Senate Democrats’ bill. Over the next 10 years, it could potentially result in government taking $16 billion more of your money.

This increase would hit households with lower incomes the hardest, making it extremely regressive. During his news conference, Governor Ferguson said the state’s tax code is already too regressive. If that’s the case, it makes sense for him to oppose further property-tax hikes, but he didn’t really say whether he supports or opposes that tax.

Higher property taxes would hurt renters as well as homeowners, potentially pushing many of them out of their homes. Our retirees on a fixed income will be equally hard-hit.

In many cases, people trying to get into their first home may not be able to break into the market because of the tax increases, affecting their ability to build generational wealth for their families.

Earlier this week, 43,153 people signed in CON against this bill before its public hearing in the Senate Ways and Means Committee. That is, by far, the most opposition recorded for any bill in the history of the Legislature.

Sadly, the news media aren’t covering it as much as some of the other taxes. I encourage you to spread the word about this harmful tax while there’s still time to stop it.

You may contact the chairs of the budget and finance committees in both chambers.

Chair of the House finance committee

Chair of the Senate budget committee

You may also contact the governor and demand that he not sign any budget that includes a property-tax increase.

Call the governor at 360-902-4111

Sincerely,

Sen. John Braun

LISTEN: My podcast on the governor’s stance on taxes and spending

Listen to my latest podcast for thoughts on some of Washington’s statewide leaders. From the Treasurer’s warnings about the rainy day fund to the Governor’s cautious stance on taxation and spending, the discussion highlights key policy debates. Plus, criticism of the Attorney General’s litigious approach and its implications for local governance and public services.

Thank you to those 43,153 who signed in CON

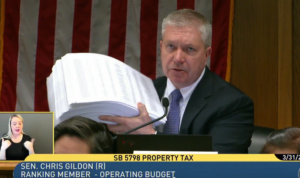

Sen. Chris Gildon, R-Puyallup, shows the enormous list of people who signed in CON against SB 5798. Thank you to everyone who shared their opposition to the property tax.

Watch: Most recent media availability

WATCH the weekly Senate and House Republican media availability originally airing April 1.

FACT: The Senate proposal to increase the property tax growth rate,

with no caps, would hurt low-income families the hardest.

Source: Dept. of Revenue